Aspen Aerogels - The Clever Way To Ride The EV Wave

While large parts of the EV value chain seem commoditised with diminishing margins, Aspen Aerogels has emerged as a compelling opportunity that is still relatively under the radar

Disclosure: As of the time of writing, I own a position in Aspen Aerogels. I may make trades in this stock in the future and my work here should not be taken as financial advice but rather for informational purposes.

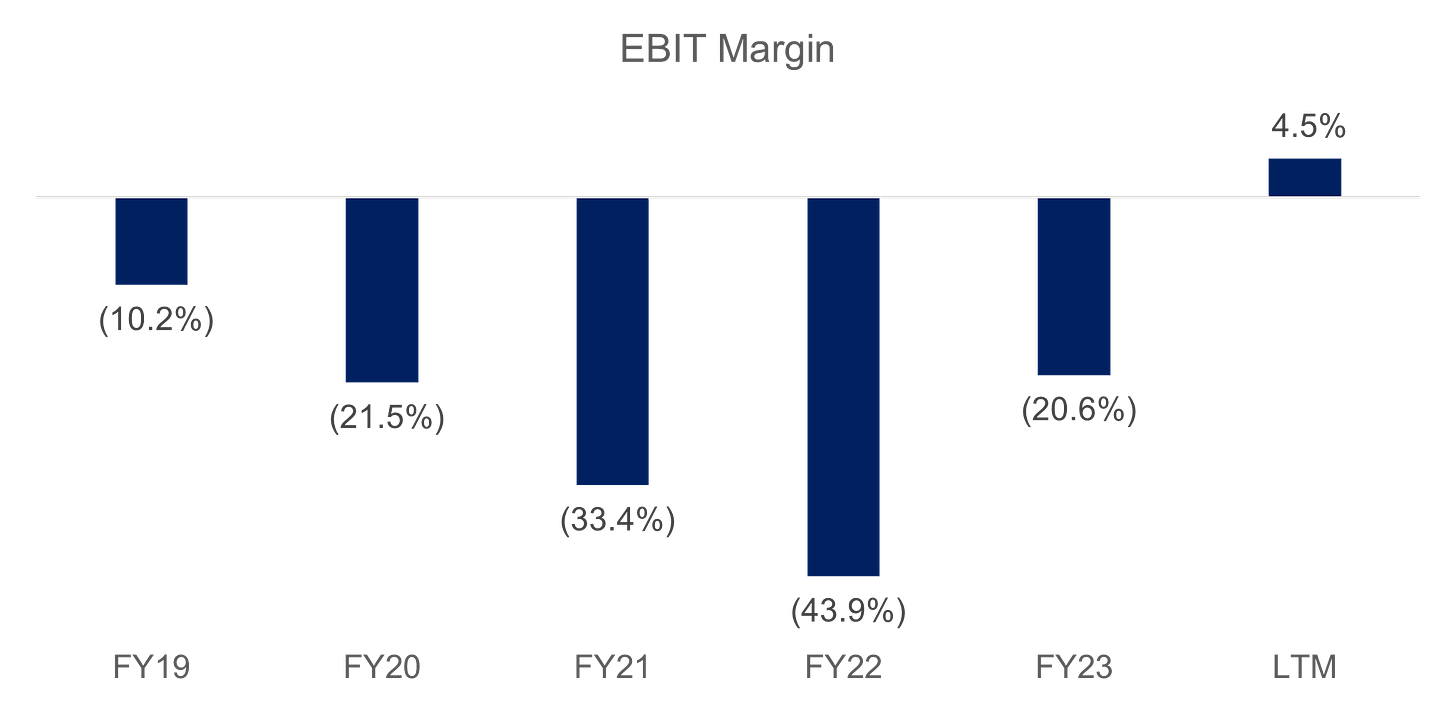

Since the start of the year, I have been trying to find a particular part of the EV value chain that would be compelling to invest in without the huge risk of commoditisation/lack of differentiation which I believe almost the entire value chain faces. This writeup will be on Aspen Aerogels, a provider of PyroThin – a thermal insulation material for EV batteries with a compelling first mover and competitive advantage. While the rest of the value chain averages margins of 20% at best, Aspen is closer to 40%, and management has signalled their desire to stay disciplined and avoid price cuts.

Investment Summary

Significant growth over the coming years as a critical supplier to EV battery manufacturers in the US, with GM as the anchor customer. Aerogels solve thermal runaway issues in batteries, limiting the propagation of cells overheating and preventing catastrophic fires in EVs. Aspen sells directly to battery OEMs and is the sole supplier to GM as it ramps EV production to a targeted 200,000 vehicles this year. Other customers include Toyota, Scania, Automotive Cells Company (ACC), Audi, and Porsche, although these total less than 15% of the 200,000 GM vehicles.

Company Overview

The Aspen Aerogel Story

Founded in 2001 and publicly traded since 2013, Aspen Aerogels is the leading manufacturer of silica aerogels—engineered insulation products with superior performance compared to traditional materials. The company's technology has its roots in space exploration; initial applications for aerogels were in spacesuits developed with NASA.

While anyone can create aerogel in a laboratory setting, Aspen's proprietary processes enable the production of aerogels in practical forms that can be applied, wrapped around pipes, cut into shapes, and moulded for various industrial uses.

Initially targeting downstream energy facilities, Aspen expanded into liquefied natural gas (LNG) and subsea applications due to customer preference for materials with superior thermal characteristics and thinner profiles. The company has effectively captured a significant share of the LNG market over the past decade, benefiting from certifications by major asset owners like ExxonMobil.

Now, the development of a new material called PyroThin, an evolution from their PyroGel product, has seen them venture into the thermal barrier business in the EV industry.

Management

Don Young has been CEO of Aspen since 2001, taking the company public in 2013.

Intellectual Property (IP)

Aspen has over 300 patents for traditional energy and thermal barriers in EV batteries. According to the company, these patents are very hard to circumnavigate and would require several hundred million dollars of R&D to pose any type of challenge. Not all of Aspen’s IP is out there and patented to prevent copying.

Products

Aspen Aerogels is the leading manufacturer of silica aerogels, a chemicals-based, engineered insulation product with proven superior performance to traditional materials.

Aspen manufactures three products:

Pyrogel: Large downstream and midstream energy facilities rely on Pyrogel insulation to help optimise critical process conditions, protect assets, and maximise process yields. Its flexible format is fast to install and adapts to complex geometry to deliver extremely low thermal conductivity and industry-leading defense against corrosion under insulation (CUI). It is also used in high-temperature applications and for fire protection.

Cryogel: Most of the largest petrochemical facilities in the world use Cryogel insulation to protect their assets and ensure smooth operations; specified in nearly 50 major LNG liquefaction and regasification projects to help keep consistent feed temperatures, minimise heat gain, and energy loss.

PyroThin: Top choice for EV battery engineers because of PyroThin’s unrivalled thermal and mechanical performance throughout the pack’s lifecycle, which can be optimised to meet specific requirements for thermal conductivity, thickness, and compression response.

The Science

Silica aerogels are complex structures derived from sol-gel reaction in which the liquid-filled pores have been replaced with air. The solid component in silica aerogel consists of tiny, 3D, intertwined clusters which comprise only 3% of volume and are very poor conductors, with air in microscopic pores making up the remaining 97% of aerogel’s volume. This air has very little room to move, inhibiting both convection and gas-phase conduction. Combined with extremely low-density solids, this provides superior thermal and acoustic insulating properties.

Why Aerogels Are Needed

The emergence of EVs has created an entirely new growth platform for aerogels, which are an ideal material to prevent thermal runaway in lithium batteries. Aspen’s aerogel thermal barrier products are designed to enhance the safety and performance of lithium-ion battery systems without sacrificing energy density.

What Is Thermal Runaway

EV sales in the US have quadrupled over the past 5 years. While rare, there have been reports of batteries failing or catching fire during normal operations, in most cases caused by thermal runaway.

As lithium battery cells cycle, they expand and contract, changing the dimension of the cell over time, which creates mechanical and thermal issues. A sudden release of energy in one cell can create a domino effect as it spills into an adjacent cell, resulting in a total loss of the vehicle. Any lithium battery is subject to thermal runaway because of several factors:

Dendrites form in the battery due to a manufacturing defect.

Overcharging.

Crash or puncture of the cells.

An external fire.

By placing aerogels with their thin profile between the cells, the propagation of energy can be slowed down before it reaches the other cells. These barriers are designed to impede the propagation of thermal runaway in lithium-ion battery systems at the battery cell, module, and pack levels across multiple lithium-ion battery system architectures. The key is to cool the cell immediately; otherwise, it will catch fire and ignite the rest of the battery pack. The goal is to prevent cells from reaching 700°C and put the fire out at the cell level, which can be done by putting in a pack barrier as sheet metal encapsulates the battery pack. Instead of a vehicle loss, it becomes a service event on an EV battery that typically costs $10k.

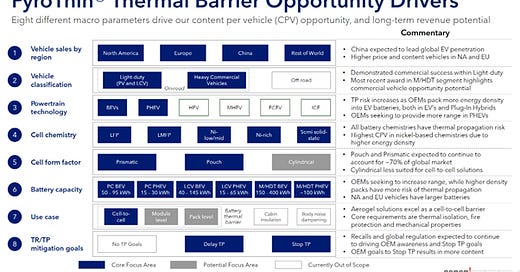

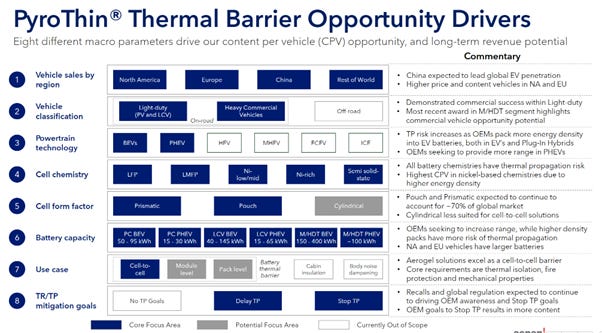

Industry Overview

The thermal barrier market extends across most of the EV market and across each of the cell chemistries, although the risk of thermal runaway in LFP batteries is considered less critical than other types of lithium batteries. There is no demand for PyroThin from cylindrical batteries due to the architectural design of the cell, which prevents the inclusion of rolled materials as a barrier. This is an important distinction considering Tesla batteries are cylindrical, which represents 25% of current US production. Aspen caters more towards pouch and prismatic batteries, which are shaped like flattened rectangular boxes and enable OEMs like GM to combine 6-24 cells in each module unit and then stack those modules vertically or horizontally. On the other hand, Tesla’s cylindrical batteries (shaped like AA batteries) can only be placed vertically and pose a challenge when isolating every single cell given the amount of space needed. Aspen’s thermal barrier products are compatible with 75% of EV production currently (pouch and prismatic cells).

Aspen's Position in the EV Battery Market

GM as Anchor Customer

GM is the current anchor customer. GM approached Aspen in late 2020 about fixing the thermal runaway issues in battery cells. At the time, GM was trying to use foams in between cells, but was found to be insufficient as it melted at around 200-300°C, well below the 700°C level at which thermal runaway occurs. GM’s Chevy Bolt recall cost them $1.8 billion, and they are paying customers $6k to sign away the liability claim.

Other Customers

Other customers include Toyota, Scania, Automotive Cells Company (ACC), Audi, and Porsche, although these total less than 15% of the 200,000 GM vehicles. Starting production next year with Audi, Stellantis, Porsche, and another German OEM that nominated Aspen that has yet to be announced. Ramp-up for other customers will start in the 2H25.

Aspen's Opportunity with Other OEMs

Aspen has invoiced specific prototype parts to nearly 20 different OEM programs. However, many of these OEMs are still developing their battery platforms, and Aspen’s opportunity with these nascent battery OEMs is limited until they can fully understand the thermal runaway problem in their own designs.

Manufacturing and Margins

Margins

Over the past 18 months, ASPN has greatly improved the cost management at its East Providence facility with gross margins now in the 20-25% range, with potential upside to the mid-30% with increased uptime. Improvement of gross margins came from fixed cost absorption from additional revenues, while materials costs were flat as a percentage.

Manufacturing Facilities

East Providence Facility: The East Providence facility will be converted to exclusively manufacture PyroThin for EV batteries. Given Energy Industrial aerogels are 10-15mm thick, thermal barriers for EV batteries are only 2-3mm thick, allowing for greater production per square foot, increasing the revenue potential of East Providence by 4x. Capacity went from $120 million to $500 million.

China Facility: Aspen’s external manufacturing facility in China will exclusively handle demand for its Energy Industrial products. In addition to lower cost operations, manufacturing in China has the added benefit of being located close to the predominant source of its raw materials. Began outsourcing manufacturing for the Industrials business to China because there wasn’t enough supply at Rhode Island for the GM contract. Likely will reach full capacity in Q4 in China.

Mexico Facility: In April 2022, ASPN began operating its 270,000 sq ft thermal barrier facility in Mexico to assemble its thermal barrier PyroThin products for EV OEM customers. Aerogel rolls produced in East Providence are shipped to this $270 million facility to complete the assembly of the final product before shipping out to its OEM customers to be installed during the assembly of the EV battery cell. The current capacity of this finishing facility matches the projected output at East Providence and can be scaled up with minimal investment to meet the expansion from Plant II.

Plant II in Georgia: To meet the significant demand, ASPN plans to triple its capacity by constructing a second manufacturing plant in Georgia, which will add approximately $1.2 billion of revenue capacity by 2027. To date, the company has incurred $290 million in cumulative capex towards Plant II, with the intent of restarting construction in Q4 2024, targeting completion by mid-2026. This is contingent on receiving an estimated $500 million DOE loan. Approval is expected before October.

How Aerogels Are Made

An aerogel is an extraordinarily light solid material created by combining a polymer with a solvent to form a gel, and then removing the liquid from the gel and replacing it with air. Aerogels are extremely porous and very low in density. The core raw materials are alkyl silicate and silane precursors that form the structure of the material with a semi-solid alcogel initially created where the silica structure is filled with ethanol. Aerogel is then produced by utilizing a supercritical extraction process which removes ethanol from the gel and replaces it with air. This allows the ethanol to be taken out without causing the solid matrix in the gel to collapse from capillary forces.

The resulting aerogel blankets are reinforced with fiber batting. They are 60-inch wide, 3-foot diameter rolls with a thickness of 1-15mm depending on the application. The base products are all flexible, hydrophobic, vapor permeable, compression resistant, and are able to be cut using conventional tools.

Research and Development

In addition to superior thermal properties, carbon-based aerogels have been found to increase the energy density in battery anodes. Although still in the R&D stage, these electrically conductive carbon aerogel materials are uniquely strong, providing the physical strength, charge and ion conductivity, and porosity required to host high concentrations of silicon in lithium-ion battery anodes.

These silicon-carbon aerogels have the potential to lower the cost and increase the energy density of EV battery systems. Extremely durable and highly conductive, carbon-based gels are now being tested in battery anodes to replace commonly used silicon-graphite chemistries that could improve the energy density of EV batteries. The limitations of graphite and silicon as anode materials pose a challenge in EV battery technology.

In EV batteries, graphite is commonly used in anodes. However, it cannot store enough energy alone. Silicon, while capable of storing more energy than graphite, suffers from significantly different expansion and contraction patterns during charge cycles. This results in the breakdown of the silicon material and the formation of a solid electrolyte interface (SEI), which degrades the battery's capacity and overall performance over time. The response centers around developing materials that can manage these hurdles, allowing for higher energy densities and longer battery life. Aspen's aerogel products help manage the physical changes silicon undergoes during charging and discharging, thus reducing degradation.

Aspen Battery Materials (ABM)

Aspen Battery Materials (ABM) is focused on a "drop-in" solution that integrates seamlessly into existing battery designs, aiming to improve energy density while being cost-efficient. The company has set product development targets, including achieving an energy density of around 300 Wh/kg (current is 280 Wh/kg) and reducing material costs to $40/kg (current is $60/kg).

The concept is to manipulate the core structure of the battery chemistry to improve energy density. Aspen products essentially provide the "scaffolding" by replacing graphite with carbon to create an extremely durable structure that can protect the anode as it expands and contracts. Several battery manufacturers are pushing the use of silicon-graphite in the anode to increase energy density; however, it degrades over a certain number of cycles. SK Energy and Evonik in Germany are core customers and also suppliers, companies that tend to bring battery chemistries in-house.

Competitors and Alternatives

Fiberglass, Silicone Foam, and Rubbers: Alternatives that have decent insulation performance but nowhere near the performance of aerogel.

Silicone Foam: Is 75-100% the cost of aerogels but much worse in performance. One might opt for silicone foam but it will be because of mechanical properties, not thermal. Foam is good at taking up space, and gaps tend to appear between cells over time from continuous expansion and contraction. Aerogels are more brittle and may crack.

Cabot Corporation: One of the primary competitors that also produces aerogel materials. However, it is not as useful in terms of the format to the thermal barrier space because it is in beads but rather in powders. Mechanically, however, they need to figure out how to keep it there as the cells expand and contract.

Financials

Valuation

I have opted a 2 year DCF this time round rather than a 5/10 year one given how tough it is to model their topline with any accuracy. In this case, management has mentioned that Plant II is definitely needed from 2027 and beyond, implying that their current $650m capacity is insufficient. On top of this, they have mentioned the possibility of being able to squeeze out an extra $200m in capacity from their current facilities. I believe my estimation of $693m for FY26 is reasonable. With the assumptions below, I have arrived at a target price of $29 (upside of 30% and an annualised IRR of 27%)

Catalysts

Aspen is hoping to receive a notice of conditional approval for a $500 million loan from the DOE (currently negotiating terms) before the November elections, which will be used to complete the expansion of Plant II, which will triple manufacturing capacity from current levels by 2027. Assuming an interest rate of 4% for the DOE loan, and that alternative financing would have required 10%, getting the loan would drive $185m in NPV of cost savings from lower cost of capital, assuming a 10% discount rate.

Aspen also mentioned they would land on a 7th award with a German automotive in Q3, which has yet to be announced. Some have speculated that Aspen might have lost the award (given that we are now in Q4), but personally I think it is more likely the announcement got pushed back at the request of the OEM.

Keep an eye on ASPN’s Q3 and Q4 earnings. They are guiding for 180k GM units, while GM themselves most recently revised their guidance downwards to 200k units.

Risks

LFP Technology: As LFP battery technology improves and takes more share of US EVs (11% of market today), it could impact total demand for thermal barriers.

Customer Concentration: GM currently represents around 90% of ASPN’s Thermal Barrier revenue.

DOE Loan Approval: DOE loan could be delayed or not granted at all.

Expert Calls

Cell Architectures: Cylindrical cells don’t need cell-to-cell thermal barriers because if you have a grid of circles, you are only touching the circle at four different points, so only those points need to be insulated, rather than the whole circumference. The gaps also allow for heat transfer technologies. With pouch cells, energy density is much better but there isn’t room for heat transfer technologies.

Flammability Requirements: V-0 flammability requirements are huge – something that will get our foot in the door or get us kicked out before it begins. Aerogel will melt before it burns, which is cool. Aerogel absolutely has the best thermal performance. Designers are figuring out what properties are important as they are going. They don’t know exactly what their needs are, and that makes it interesting and challenging for ASPN or any other material provider. There has been a couple of redesigns and utilization of different material sets.

Supply Chain: Supply chain for silicones is actually very similar to the supply chain for aerogel manufacturing because the precursors for both materials are actually very similar. Volatility for pricing of silicone is high but the pricing differential with aerogel should remain the same.

Competition: Competitors are going to be able to use similar silanes in different ratios and formulate their products to try and come up with the performance of a silica-based aerogel like ASPN’s products. Where they would have a hard time is on the additives. ASPN has 20-25 years of development cycle history; competitors, especially those in China, will definitely try to figure it out and eventually get close, but it will not be easy. And by then, ASPN will be developing their next-generation aerogel. China players freely infringe on ASPN’s patents and yet have only managed to replicate up to 90% of the performance of ASPN’s legacy products in Industrials.

Market Dynamics: With the Energy Industrial business, barriers are quite high once you are locked in. With the EV market, it is different. Getting the materials qualified will be the toughest part, demonstrating comparable performance, but once that is done, change could be as quick as 6 months to 2 years.

Threat from LFP Batteries: LFP is the aerogel killer and the biggest threat to the aerogel market. LFP has lower probabilities of thermal runaway occurring, and it is at higher temperatures where it would occur. If an LFP reaches the same energy density as lithium-ion, customers will switch. LFP will significantly reduce the risk of thermal runaway such that you would not need aerogel for thermal runaway protection.

Demand Volatility: There was a delay to ASPN’s Bulloch County plant because there have been changes in demand dramatically. GM’s forecast is pretty volatile and very seesaw, and this has caused a whipsaw effect in the supply chain, and it is not just for ASPN. In my opinion, whatever GM is putting out, I don’t believe. Demand has been so volatile and so misunderstood that timing when capacity comes online to match the demand is tough.

Conference Call Highlights

Barclays Conference (4 Sep)

Initial applications for aerogels were spacesuits with NASA. Anyone can make aerogel in the lab. What is proprietary is making it in a form where it can be applied and wrapped around pipes and cut into shapes and mold.

Currently, we have about $150 million of supply to meet demand in the energy industrial insulation market, and we expect more demand than the $150 million. If you get certified by the likes of ExxonMobil or one of these large asset owners, then you only have to deal with eight people to capture a pretty large market. LNG is a market that ASPN pretty much had to themselves for the past 10 years.

Began outsourcing manufacturing for the Industrials business to China because there wasn’t enough supply at Rhode Island for the GM contract. Likely will reach full capacity in Q4 in China.

A lot of EVs you see today, before aerogels came around, OEMs would put a barrier to shield the overall battery pack like a sheet of metal to buy you a little time. Even then, when they require a ton of water and time to put out.

Same manufacturing process for EVs as the Industrials business.

Gained a lot of operating leverage. Main constraint at Rhode Island is volumetric. Given that PyroThin is ~3x thinner than Pyrogel, and assuming pricing per square foot is around the same, capacity has increased and operating leverage has increased. Capacity went from $120 million to $500 million.

The average vehicle would have 100 of these, one between every single cell. For a vehicle with pouch cells, it is about $900 to $1,500 per car depending on the size of the battery pack. For prismatic cells, it is about $350 per vehicle. Foam is cheaper but burns at 300°C and makes things worse. When you put the price in the context of the overall battery pack, costing $13k for 150kW, it is reasonable.

EV market year-to-date hasn’t grown. Tesla is losing a lot of share, and the gainers have been the OEMs we supply, Toyota and GM.

Starting production next year with Audi, Stellantis, Porsche, and another German OEM that nominated us for the business we haven’t announced yet. Ramp-up for other customers will start in the 2H25.

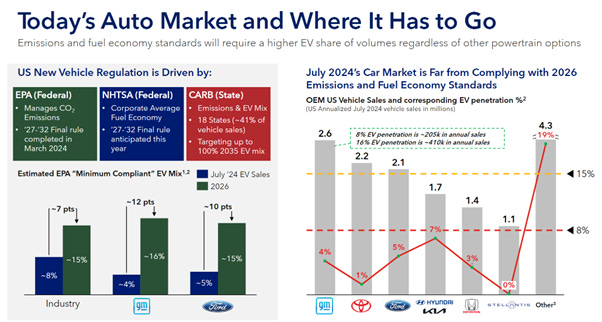

In 2026, the US market needs to be at least 15% of new vehicle retail sales. Currently, it is only at 8%.

Tesla sort of doesn’t handle thermal runaway. If a cell in Tesla goes into thermal runaway, the car will burn to the ground. They are relatively conservative in terms of how they use the cells and how they charge them. So, for example, it might show a 100% charge but it’s actually at 80%, and when it is showing 0%, it is probably closer to 30%.

In 2024 and 2025, EV demand is not being driven by overall consumers wanting more EVs, but rather by OEMs’ willingness to incentivise it with a bunch of cheap leases and the $7.5k tax credit and some cash on the hood of these cars.

Canaccord Conference (13 Aug)

Improvement of gross margins came from fixed cost absorption from additional revenues, while materials costs were flat as a percentage. $500 million of revenue capacity on EV side and $150 million on energy side. Trying to get an extra $100 million of revenue out of those assets on both sides each.

OEMs won’t admit it, but they face a significant regulatory wall from an emissions and fuel economy standards perspective where things will get real in 2026 and more so in 2030. OEMs need to get to 15% EV mix in 2026 to comply with regulations. 15% mix for GM is about 400,000 vehicles. Audi and Stellantis program will launch around 2H25. Porsche will be 4Q25.

EVs that don’t use ASPN are using polyurethane foam, which does a great job in buffering any vibration or harshness that the cells are subjected to while the vehicle is moving, but does nothing in terms of thermal isolation.

ASPN provides a quote; the OEM doesn’t like the quote because they want the part to be free and claim to have competitors. ASPN doesn’t see any. There have been cases with ACC and Stellantis where ASPN lost the business to ceramic-based material only to be asked again a couple of weeks later.

Could discount the product and get sourced immediately, but there is no benefit in that. Being careful with pricing to make sure capital is generated appropriately. Barriers to entry are really high, and ASPN has a healthy lead.

If we were sitting working at one of the big materials companies chasing the EV opportunity, first, if you open up USA Today, it's looking less and less attractive every year. So good luck getting that approved. Then you would need to get over our IP, which pretty much be infringing from day one. As soon as you try to make any sort of blanket-based aerogel product, you're infringing on our IP. And then second, you would need to get all the capital and the scale to get there. And then most importantly, you need to build a relationship with the OEMs. So it's this pretty serious chicken or the egg problem for anybody that's trying to pursue this. You can't get the relationship if you don't have the scale. You can't get the scale if you don't have the capital. You can't get the capital if you don't have the relationship. So, I truly believe that if it weren't for the scale that we had with our energy business, GM would have never sourced us. And so the fact that PyroThin started as a very close cousin of the energy Pyrogel, the energy product, is what got us over that chicken or the egg problem.

TD Cowen Conference (21 May 24)

Can’t just be adopted by an OEM on a rolling basis, only possible when a platform like Altium was being designed from scratch, or Audi where the battery pack is going through a meaningful redesign or update. OEMs starting to take thermal runaway more seriously to protect goodwill that has been built up.

Some of the wins we had in 2023, you will start to see some revenue in 2024, then noticeable revenue in 2025, and significant in 2026.

Roth Conference (18 Mar 24)

In a position to generate $650 million with assets and maintain 35% gross margins and 25% EBITDA margins. Don’t think the headlines are as bad as what is being suggested. OEMs are moving towards the design of their own battery platforms. Some of the traditional OEMs were designing on a per nameplate basis, which is less efficient and less economical. Second plant to have $1.2 billion of revenue capacity for thermal barrier business. Will take 6 to 8 quarters to complete it once construction is restarted.

Earnings Calls

1Q24

PyroThin went from $7 million in 2021 to $56 million in 2022 to $110 million in 2023, will more than double in 2024. Gross margin expansion driven by transition to external manufacturing facility. Expecting to add additional design awards to roster as OEMs finalise their battery platforms.

Do not advise looking at customer’s volume plans to ASPN’s revenue expectations. There is a significant delay of weeks or months for a finished EV thermal barrier part that we invoice customers to end up in a produced vehicle. We are making these parts 2 to 3 months before they are put in a car.

Provided and invoiced prototype parts for nearly 20 different OEM programs (8-12 OEMs). Gating item is the development of these OEMs’ battery platforms themselves. Anything awards we win in 2024 will more likely begin scaling in 2026. Not really considered by other OEMs until you are meaningfully producing for one of them.

OEMs trying to take as much weight and cost out, and PyroThin helps with that. A lot of these awards are actually dependent on the customer’s timeline more than ours. Have been in situations where you start shipping production parts to them and you still don’t have the contract. But the POs are your contract. As long as you are technically designed in and you have the right terms in those POs, it is not a problem. Would not take the lack of an update on the 6th OEM as a negative sign. Still a lot of engagement and continue to sell them more prototype parts.

Have tightened up value chain to deliver some incremental savings. In the old value chain, a lot of raw materials would be coming from China, and ASPN would have to pay a 30% tariff, and 2/3 of the energy business would go back outside the US.

No matter how we sliced the demand, Plant II is needed in 2027. Some programs are for cell modules that are potentially for PHEV. Content per vehicle opportunity not the same as full EV platform, so not the priority. $500 million and 12-18 months to complete Plant II. Seeing the emphasising of hybrids in investor communications, not necessarily in development road maps and industrialisation plans for these companies. Not seeing people internally working on those hybrids, and in some cases the folks working on the modified ICE portion of the powertrain have been laid off.

No commodity pass-throughs with customers.

2Q24

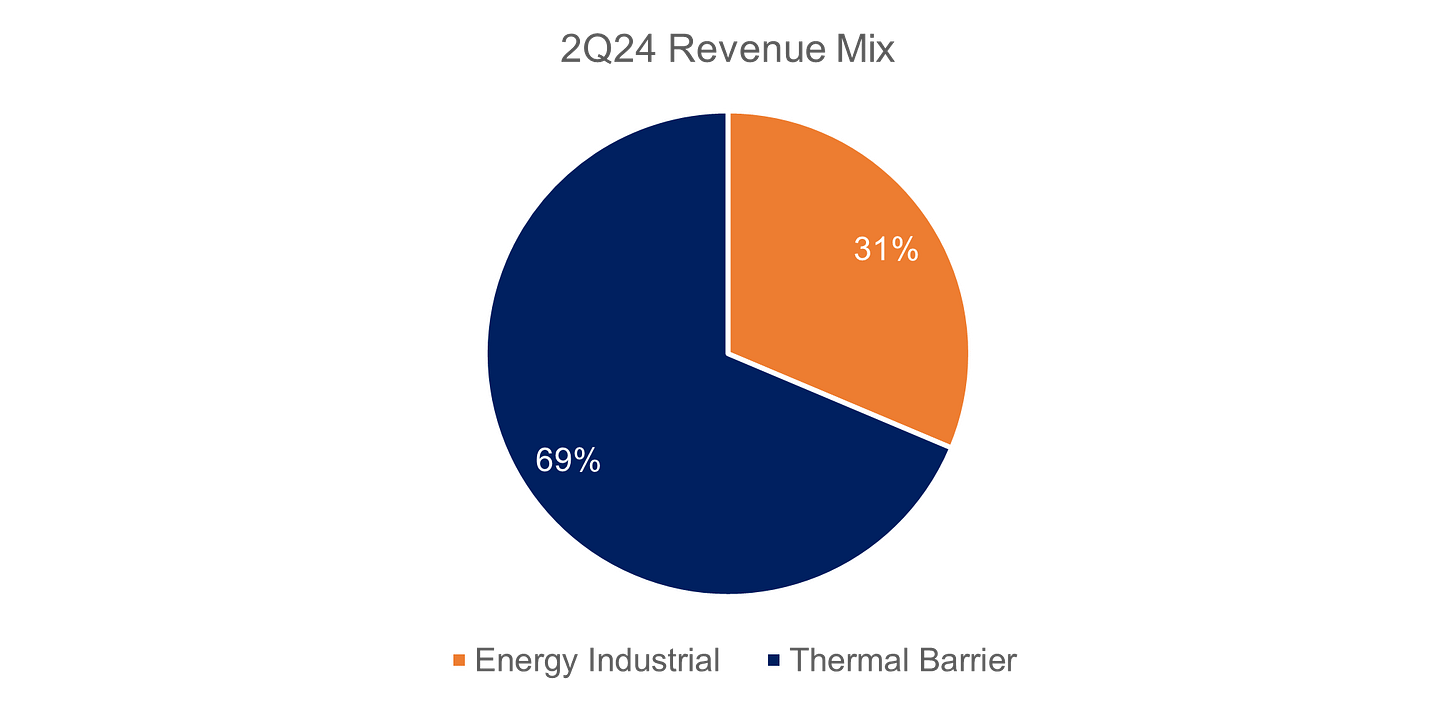

Energy Industrial revenues of at least $150 million and aiming to double this in the medium term. Believe we have over $50 million of upside to our baseline revenue outlook, predominantly in our EV PyroThin thermal barrier business.

During Q2, announced 6th design award to supply the next-gen battery platform for Porsche, which is expected to underpin multiple nameplates for Porsche and expected to start production in 2025. In final contract negotiations with a major European OEM for a 7th award. Current annual revenue run rate of $470 million.

Most of the one-time charges of obsolete inventory and equipment related to customer-driven engineering changes that were implemented in Q1 were reversed in Q2. Best way to look at the profitability of the EV thermal barrier business is by looking at the results of 1H rather than each quarter.

Vehicles that were developed before ASPN had a cell-to-cell solution are aging and losing share. PyroThin is equipped on 100% of EVs sold by GM, Toyota, Honda in the U.S.

GM, for example, to comply with regulations, would need to quadruple EV penetration from 4% in July 2024 to around 16% by 2026 to barely be compliant. OEMs take these regulations more seriously than one would think from reading the press or IR materials.

There isn’t another material that can deliver the three requirements that OEMs want: Thermal isolation, thinnest profile possible, mechanical properties.

Status Update Call

Limitation of the old note – was convertible at $29.94 per share, which created overhang. On top of that, because it was an unsecured note, ASPN couldn’t put any debt ahead of it in the capital structure and couldn’t add more than $50 million of indebtedness over a 12-month period of time.

A plug-in vehicle would have a battery that is roughly 1/4 to 1/3 the size of an EV. Most PHEVs use prismatic cells, so the CPV (content per vehicle) would be 1/3 of CPV on prismatic cell EVs, so $100 to $150 per vehicle.